You may hate to have to do it, but assessing finance charges for late payments may improve your overall cash flow.

There are a myriad of ways to bring in customer payments faster and improve your cash flow. You can:

- Get a merchant account and let customers pay you electronically

- Offer a discount for early payments

- Shorten the payment due cycle (21 days instead of 30 days, for example)

- Be more aggressive about collections

QuickBooks can help you take all of these steps. It also offers a fifth option: assess finance charges for tardy remittances.

Maybe you don’t want to do this because it seems like a less-than-friendly way to treat customers – especially valued ones. But you’re not in the business of lending money, which is what you’re doing when you continue to let your accounts receivable slide. So, here’s how to do add finance charges to your payment policies.

Multiple Issues Involved

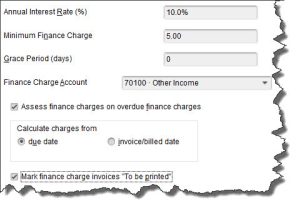

Before you can start adding finance charges to tardy payments, you’ll need to let QuickBooks know how you want them handled. Open the Edit menu and select Preferences. Click the Finance Charge tab in the left vertical pane, then the Company Preferences tab in the window that opens. You’ll see something like this:

You’ll need to decide on your QuickBooks Finance Charge settings before you can begin to apply these late fees.

What Annual Interest Rate will you charge? Will there be a Minimum Finance Charge? Do you want to offer a Grace Period? If you’ve never worked with finance charges before, you might be at a loss as to how you should answer these questions. We can talk it through with you if you’d like, and make sure you’re selecting the correct Finance Charge Account. In our example, QuickBooks defaulted to 70100 – Other Income, which may be the best option for you.

The next question may require some research. Some jurisdictions don’t allow you to Assess finance charges on overdue finance charges; you’ll need to find out. If there’s any doubt, make sure that the box in front of that option isn’t checked.

QuickBooks also needs to know on what date it should start calculating finance charges: on the due date or invoice/billed date. Finally, check the box in front of Mark finance charge invoices “To be printed.” QuickBooks doesn’t include finance charges on invoices themselves; it bills them on separate invoices. Check this box if you want the software to print all of them as a batch.

When you’re done here, click OK.

Applying the Charges

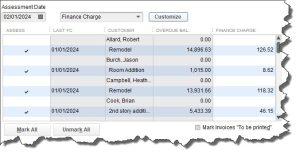

By selecting an Assessment Date, you’re telling QuickBooks how many late days should be included in its finance charge calculations.

When you’re ready, open the Customers menu and select Assess Finance Charges. A window like the one in the image above will open.

QuickBooks, of course, performs all of the required calculations in the background. But it must first know what specific date you plan to actually assess the charges so that it can determine the number of late days that should be included. This may not be the current date, so be sure the Assessment Date is correct before proceeding.

All you have to do here is make sure there’s a check mark in front of every finance charge that should be invoiced (they’ll probably already be there, but you should verify this). If you send statements, clear the box in front of Mark Invoices “To be printed.” The finance charges will appear on the next statement.

When you’re satisfied, click Assess Charges.

Dispatching the Charges

Your finance charges have now been recorded in QuickBooks as individual invoices. When it’s time to print, open the File menu and select Print Forms | Invoices. You’ll see your numbered finance charge invoices displayed like this:

You can see your finance charge invoices when you go to print them.

(Of course, if you email invoices, you’d click on File | Send Forms.)

It’s a good idea to notify your customers before you start assessing finance charges. This will give them a chance to catch up, and no one will be surprised to see the extra invoices.

QuickBooks does the hefty lifting as far as calculations are concerned, but it’s very important that you set your finance charges up correctly. Customers will be annoyed by mistakes. And it’s much easier for us to help you get this tool set up right from the start than to have to go in and untangle errors. Let us know if you plan to start assessing finance charges, and we’ll help make it work for you.

Social media posts

There are numerous ways to encourage prompt payments from your customers. Assessing finance charges is one of them. QuickBooks can help do this.

Positive cash flow is dependent in part on how quickly your customers pay their invoices. We can help you set up finance charges to encourage this.

QuickBooks dispatches finance charges by creating additional invoices, which can be confusing. Let us help you understand this process.

Do you know what is a reasonable finance charge to assess customers who pay their invoices late? We can help you make such decisions.